| GS100: The Global Outsourcing Compendium | |||||||||||||||||||||||||

| View | Download | ||||||||||||||||||||||||

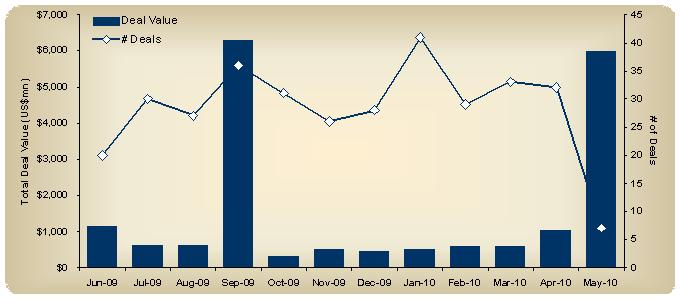

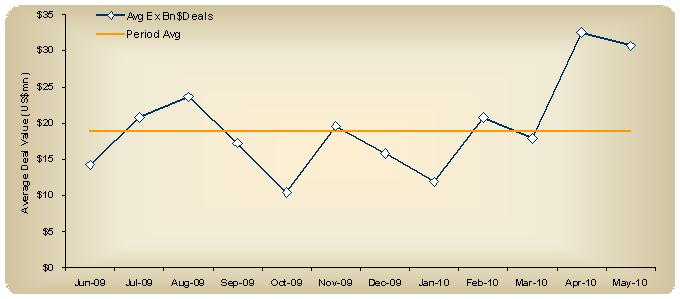

The pace of mergers & acquisitions (M&A) was significantly slower in 2009. However, with the economic recovery getting grounded in reality early this year, organizations reinstated their zest for inorganic growth. In the last two months, deal size has crossed over US $30mn as compared to the average deal size of below US $20mn in the last quarter of 2009 and first quarter of 2010.

The overall data for M&A includes software and services. In the last one year nearly 340 deals were signed worth over US $18 bn. The number of deals per month was within the range of 25-35. The period witnessed three billion dollar deals; largest being US $5.8 B acquisition of Sybase by SAP in May 2010. The two others were US $3.9 B acquisition of Perot Systems by Dell, and US $1.8 bn acquisition of Omniture by Adobe in September 2009.

Continued...

| | | | | | |

|